is car loan interest tax deductible in india

In India loans and tax deductions often go together. You can get tax exemptions for Home Loans Education Loans and even in some cases for Personal Loans.

Tax Benefits On Electric Vehicles In India All You Need To Know The Economic Times

The interest paid on a business loan is usually.

. 10 x the number of days for which interest was payable. You cant claim deduction of car loan if its not an electric car in case of salaried person. So when you are claiming tax rebate on car loan deduct the interest you have paid towards your in that year from your taxable income.

For vehicles purchased between. In Indian context if the loan is taken for business than you can claim interest paid on mortgage loan as deduction from business profits. The tax rebates you can claim if youve taken out a chattel mortgage include the GST you paid when buying the car the loan interest youre paying and the cars depreciation.

Principal loan amount is not tax deductible and do not offer any tax benefit. For example if 70 of your car use was for business and 30 for personal affairs then you can only deduct 70 of the car loan interest from your tax returns. The interest paid can be added as a.

You cannot deduct the actual car operating costs if you choose the standard mileage rate. Replied 30 October 2021. May 10 2018.

As the interest on car loan is allowed to be treated as an expense this reduces the taxable profit. You can write off up to 100. This means that if you pay 1000.

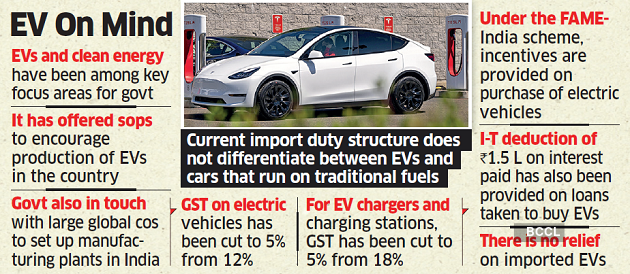

People who choose to acquire an EV on loan will be eligible for a tax deduction of Rs 15 lakh. Answer 1 of 2. Tax Exemptions on 10003 Home Loans 10003 Education Loans 10003 Car Loans 10003 Auto Loans 10003 Personal Loans.

From FY 2020-2021 onwards tax incentives under Section 80EEB are available. In case of Business the car will be shown as an asset. Not all interest is tax-deductible including that which is associated with credit cards and auto loans.

Car loan interest is tax deductible if its a business vehicle. You cant deduct your car payments on your taxes but if youre self-employed and youre financing a car you use for work all or a portion of the auto loan. The standard mileage rate already.

Common deductible interest includes that incurred by mortgages. 10 Interest on Car Loan 10 of Rs. Show you use the car for legitimate business purpose.

For instance if you use the vehicle 50 percent of the time for business reasons you can only deduct 50 percent of the loan interest on your tax returns. If a self-employed person uses their car for business 40 percent of the time and personal use 60 percent of the time then the person can. If its a loan for buying a commercial or.

For example if you use the vehicle 50 of the time for business purposes you can only deduct 50 of the loan interest on your tax returns. But what about Car Loans. This means that if you pay.

To deduct interest on passenger vehicle loans take the lesser amount of either. All about tax benefits on loans in India. Business loan interest amount is tax exempted.

However for commercial car vehicle and. F the car you purchase is for personal use you cant deduct the interest you pay on a car loan from your tax return. To claim car loan tax exemptions from Income Tax you need to show that you are using the car for legitimate business purposes and.

Article continues below advertisement.

Are Mortgage Payments Tax Deductible Taxact Blog

How To Maximize Your Mortgage Interest Deduction Forbes Advisor

Coronavirus Tax Relief Covid 19 Tax Resources Tax Foundation

Are Home Equity Loans Tax Deductible Nerdwallet

Are Medical Expenses Tax Deductible

Car Loan Tax Benefits On Car Loan How To Claim Youtube

How To Calculate Interest Rate On A Car Loan Metro Honda

Is Personal Loan Interest Tax Deductible Experian

What Types Of Personal Loan Interest Are Tax Deductible

The Ultimate Guide To Tax Deductions For The Self Employed Article

Which Is Better For Taxes Leasing Or Buying A Car Bankrate

How To Claim Car Loan Tax Exemption Bank Of Baroda

Publication 936 2021 Home Mortgage Interest Deduction Internal Revenue Service

Business Travel Expenses For Rental Owners 2022 Update Stessa

India Budget 2019 New Incentives For Electric Vehicles Tax Benefits For Buyers Technology News The Indian Express

Tesla Centre Mulls Incentives For Tesla Provided Carmaker Sets Up Manufacturing In India The Economic Times