montana sales tax rate on vehicles

If you would like to know if a dealer is legally licensed you can email dojdealerinfomtgov or call the MVDs Vehicle Services Bureau at 406-444-3661 option. You should contact the vehicles manufacturer directly.

How To Legally Avoid Paying Sales Tax On A Used Car Financebuzz

The Montana State Montana sales tax is NA the same as the Montana state sales tax.

. Only a few counties enforce a local state tax which is why Montanas average combined sales tax rate is only. If you need assistance gathering contact information call the NHTSAs Office of Vehicle Safety Compliance at 202 366-5291. Rates include state county and city taxes.

Montana County Vehicle Tax. Up to 25 cash back If you form a Montana LLC and have it purchase and take title to a motorhome or RV you wont owe any sales tax in Montana. Car Sales Tax on Private Sales in Montana Since there is no state sales tax you do not have to worry about paying any taxes on your vehicle no matter how you purchase the car.

The latest sales tax rates for cities starting with A in Montana MT state. 368 rows There are a total of 68 local tax jurisdictions across the state collecting an average. Montana has no statewide sales tax for vehicle purchases.

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the. 2022 Montana Sales Tax Table. Vehicle owners to register their cars in Montana.

Because there is no sales tax in the state and several counties also do not levy a local option tax the cost of registering luxury vehicles here. What is the sales tax rate in Missoula Montana. Free Unlimited Searches Try Now.

Heggen Law Office PCs Montana RV and vehicle registration services are designed for you to avoid sales tax and high licensing fees. You can learn more about licensing and distribution from the Alcoholic. Ad Lookup MT Sales Tax Rates By Zip.

While many other states allow counties and other localities to collect a local option sales tax. While the base rate applies statewide its only a starting point for calculating sales tax in. 2020 rates included for use while preparing your income tax deduction.

Tax Free Montana Vehicle Registration Services. In Oklahoma the excise tax is. But this doesnt mean you wont.

This is the total of state county and city sales tax rates. The minimum combined 2022 sales tax rate for Missoula Montana is. Buy From a Trustworthy Seller.

The Montana Department of Revenue administers the states licensing distribution and taxation on Alcoholic Beverages. The tax must be paid by the purchaser when the purchaser applies for an original Montana license through the county treasurer. The Montana State Montana sales tax is NA the same as the Montana state sales tax.

The new car sales tax on vehicles subject to the provisions of. While Montana does not charge a state sales tax on cars counties can impose a vehicle tax depending on the value of all new vehicles trucks and. Some states such as California charge use taxes when you bring in a car from out-of-state even if youve already paid the sales tax on the vehicle.

How To Avoid Paying Car Sales Tax The Legal Way Youtube

Tennessee Car Sales Tax Everything You Need To Know

Oregon Vehicle Sales Tax Fees Find The Best Car Price

What States Charge The Least Most In Car Taxes Carvana Blog

Oregon Vehicle Sales Tax Fees Find The Best Car Price

Iowa Sales Tax Small Business Guide Truic

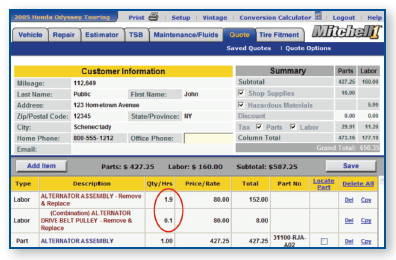

Auto Repair Labor Rates Explained Aaa Automotive

Sales Taxes In The United States Wikiwand

Fact 900 November 23 2015 States Tax Gasoline At Varying Rates Department Of Energy

How To Buy A Car Out Of State Nextadvisor With Time

Is Buying A Car Tax Deductible Lendingtree

Think Twice About Registering Rv In A Montana Llc Rv Tailgate Life Rv Rv For Sale Rv Life